Like all global elastomer markets, silicone elastomers have suffered a serious setback since the beginning of 2020. However, silicone elastomers are rebounding rapidly due to the increased demand for use in medical applications related to the COVID-19 pandemic. Added to this is the rapid increase in demand for electric vehicles, which has generated an added demand for silicone elastomers, in particular for applications related to battery management and LED lighting systems.

In a new report from Smithers,

The Future of Silicone Elastomers to 2026, the global market for silicone elastomers is estimated at 414.8 thousand tonnes in 2016, growing to 495.5 thousand tonnes in 2019, with a compound average growth rate of 6.1%. Due to the COVID-19 pandemic, this dramatically fell to an estimated 410 thousand tonnes in 2020. It is expected that it will grow to 555.9 thousand tonnes by 2026, but at a reduced rate of 5.2%, due to the time and efforts needed to restore the market.

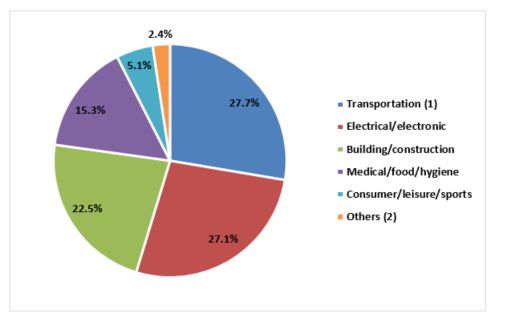

Use of silicone elastomers in transportation applications, the largest sector, is forecast to slightly gain market share from 27.7% of the market in 2020 to 28.1% in 2026.

The global market for silicone elastomers by end-use, 2020 (%)

COVID-related financial hardship

COVID-related financial hardship

Many silicone elastomer producers, convertors and end-users have realised extreme financial problems, not to mention raw material shortages. While certain financial assistance is available, it might not always be enough to solve the problem of lost markets. Smaller companies are witnessing situations close to bankruptcy, plus paying back grants and loans is a serious current and future problem.

Medical applications

The growth in the silicone elastomers market has to a very large extent been due to the increased demand for medical applications, such as masks, tubing, and coated hospital fabrics. From a material processing point of view, the liquid injection moulding of silicone elastomers has expanded recently along with the increased demand in the medical sector. Additionally, silicone elastomers may start to replace plasticised PVC for medical and food contact applications, and they meet the high purity demand required by the medical industry.

Transportation applications

As the transportation market gets back on its feet after the impact of COVID-19, its use of silicone elastomers will grow. This will be steady growth since the automotive market, which is the largest part of transportation applications, needs time to get back on its feet. It is in fact the increase in the market for electric vehicles, which will have the major effect on this sector. The principal applications for silicone elastomers are in batteries and battery management systems.

Electrical and electronics applications

Due to increasing use of LEDs in lighting applications, the electrical and electronics applications will generate large growth for silicone elastomers. Urban lighting is ready to switch to LEDs, which will give a more powerful illumination than the halogen systems currently in place. In fact, halogen lighting is now banned in most countries. It is the vast cost of replacement that is slowing things down and it will not be until the COVID-19 situation is under control, that the necessary financing will be available.

Leading regional producers

In the period of 2016 to 2019, the silicone elastomers’ market was dominated by the United States of America (22.7%): China (19.4%), Germany (7.8%), Japan (6.5%) and India (6.2%) that order. Each of these countries dominated the North American, Asian/Pacific and European markets, with no other countries achieving more than 6% market share. By 2019 it is estimated that, the US had dropped to 22.4% with China catching up with 21.1% market share. Germany also dropped slightly to 7.5% market share. India at 7.2% is estimated to have overtaken Japan (6.1%).

There are signs that these trends will continue up until 2026. In 2020, China is estimated to have gained slightly at 21.9%, but the US managed to stay ahead at 22.8%. Germany also picked up slightly with 7.8%, while India continued to overtake Japan with 7.2% versus 6.2% respectively.

The forecast for 2026 market shares show a very similar scenario, with China taking the lead at 26.6%, versus the US falling to 21.2%. Germany (6.7%) will likely give way to India (8.1%), leaving Japan at 5.5% market share. No other country is likely to achieve more than 5% market share, by the end of 2026.

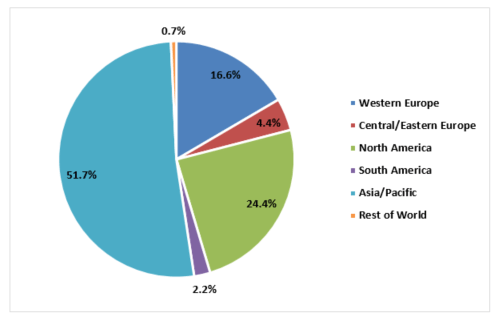

The global market for silicone elastomers by region, 2026 (%)

![]()